Know whosays yesStop guessing whichlenders will say yes.

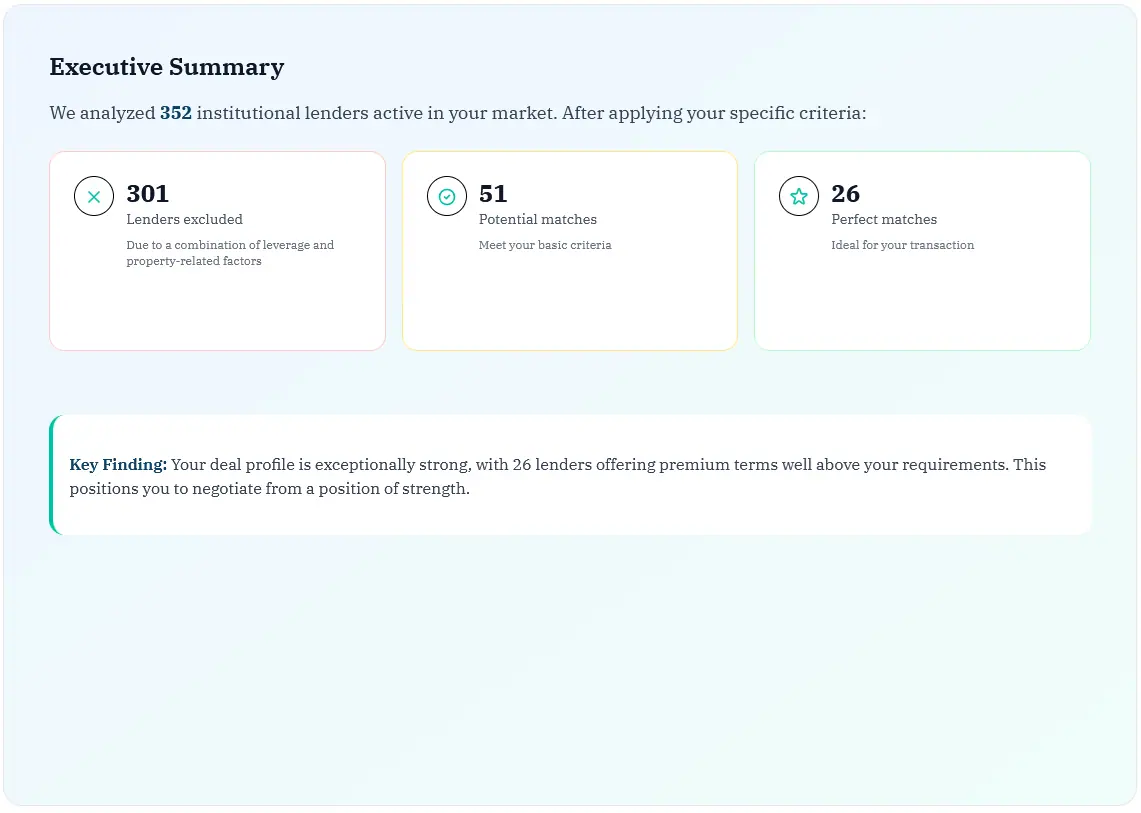

Enter your deal. See exactly which lenders will say yes - and at what terms.Enter your deal once. We match it against 350+ lenders' actual criteria - and show you exactly who can fund it, at what terms. Transparent. Instant. Complete.

Free • No signup required • Results in 60 seconds

- Instant matching to qualified lenders

- £100k - £50m | Development, bridging, refinance

- Competing term sheets, not blind hope.

Team from:

.png.webp) Chartered Surveyors and valuers - ex-investment banking, ex-City law

Chartered Surveyors and valuers - ex-investment banking, ex-City law

Most investors approach 3-4 lenders.The ones who get funded fastest approach 50+.

- Deals collapse when your only lender pulls out at week 10 into the process. With 3 contacts, you scramble. With 50, you have certainty.

- Limited access means negotiating blind - accepting terms without knowing if better ones exist two calls away.

- Competing term sheets change the game. When lenders know others are bidding, pricing drops and timelines tighten in your favour.

THE OLD WAY

A handful of familiar names

Typical coverage: 3-4 lenders.

See who's actually lending

Full market: 50+ qualified matches (from 350+ tracked).

PE firms deploy treasury teams to canvass 100+ lenders and extract competing terms. LoanLabs gives you the same firepower without the headcount.

How many lenders never see your deal?

Find out right now. Takes 60 seconds. For free.

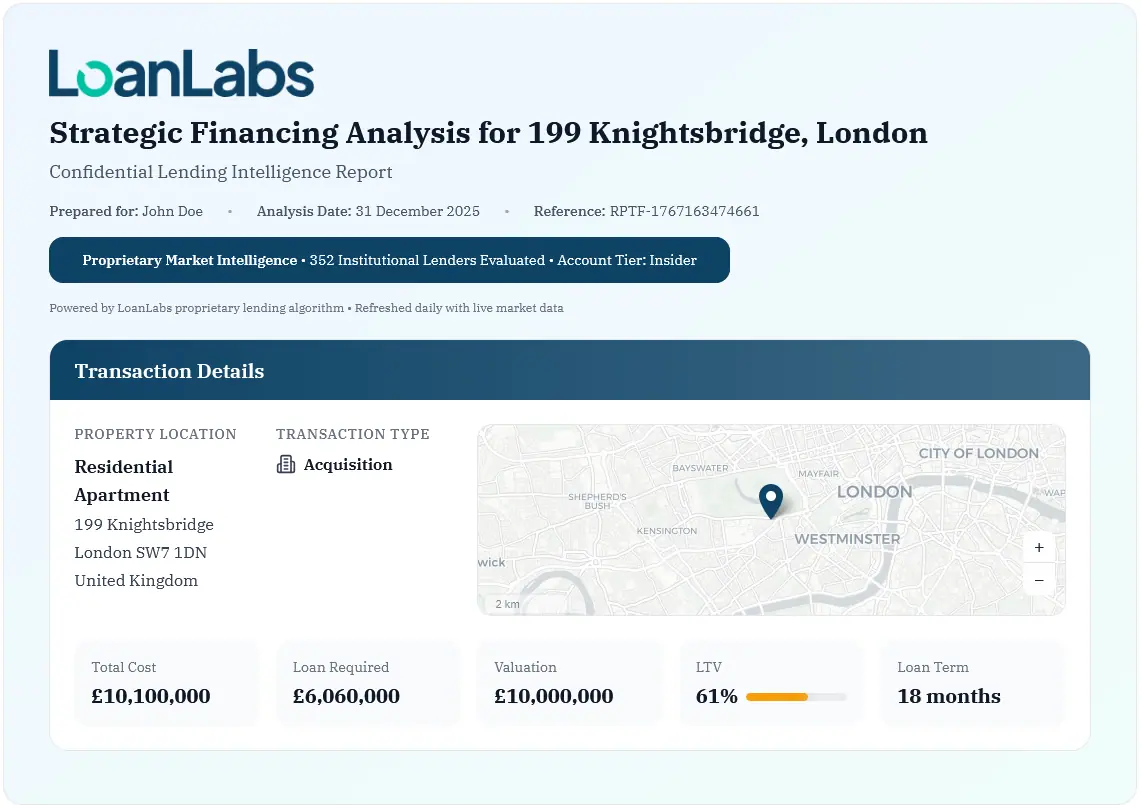

Describe your deal

Property, loan size, timeline. 60 seconds.

We check 350+ lenders

Every lender’s actual criteria. Updated continuously.

352 lenders evaluated

52

qualified matches

Best terms found

Results are filtered to show the lenders that actually fit your deal.

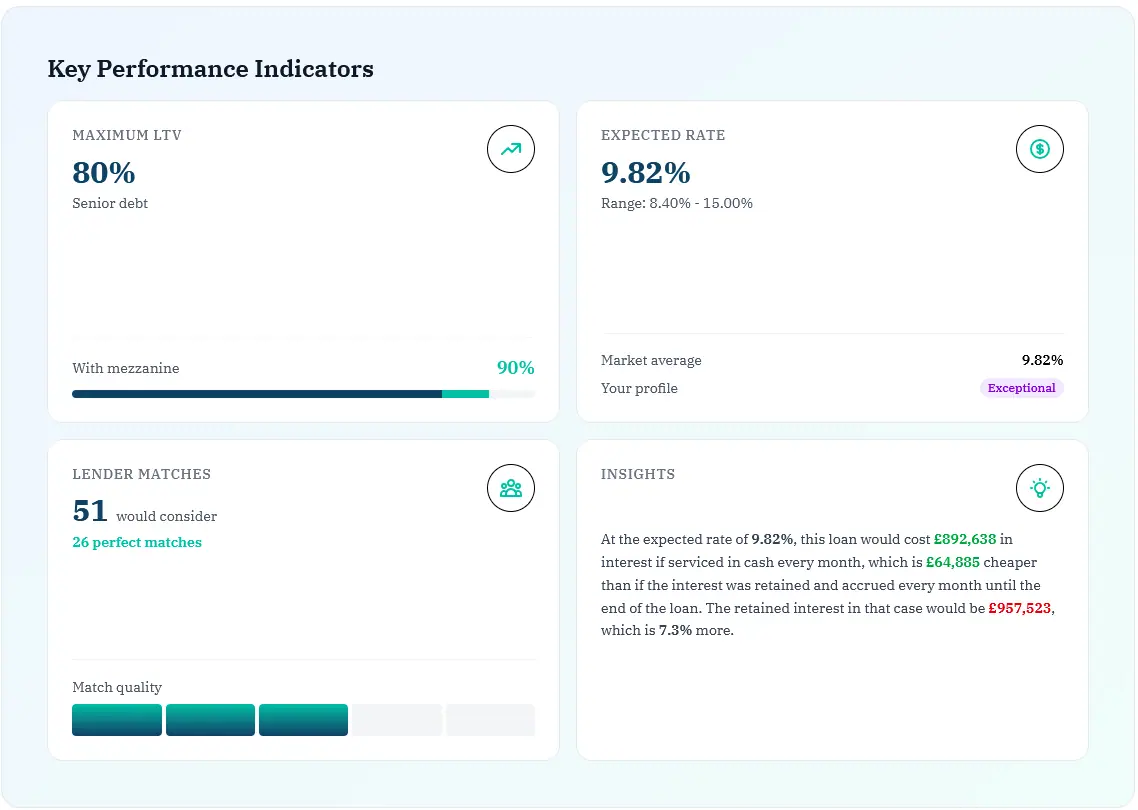

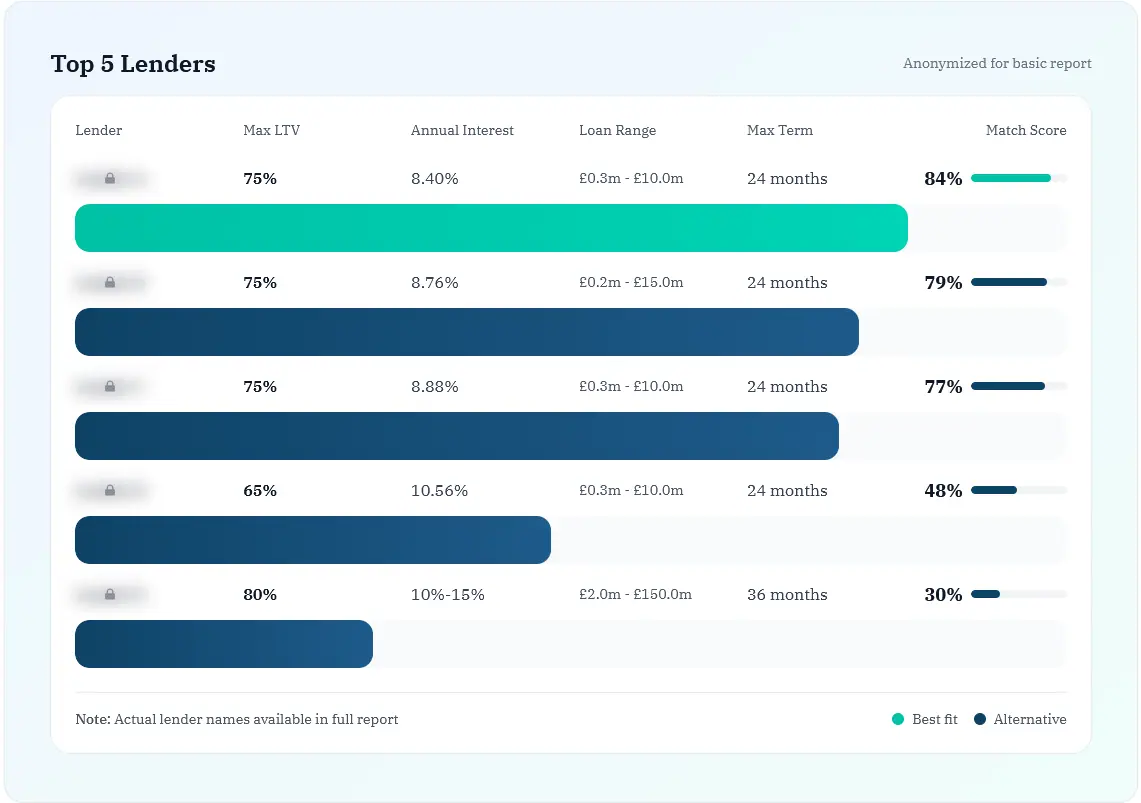

Compare real terms

Real rates, real leverage, real timelines. Side-by-side.

8.9%

70% LTV

3–4 wks

8.2%

75% LTV

2–3 wks

9.1%

80% LTV

4–6 wks

Compare real rates, leverage, and timelines side-by-side.

Built from both sides of the table

Every lender has two sets of criteria. The one they publish.And the one that gets deals approved.

PREDICT THE YES

We know which lenders say yes

Our team includes former credit committee members from European banks and private debt funds. We know what gets approved because we've done the approving.

FIND YOUR EDGE

We find what others miss

The LoanLabs team has acquired and exited institutional assets at 40%+ returns. We find overlooked value because our own capital depended on it.

SPEAK LENDER LANGUAGE

We fix what gets deals rejected

Our principals have developed 100+ unit residential schemes and structured their own debt facilities. We know what causes declines because we've been on both sides of the table.

When you get a LoanLabs report, you're not getting a list of lenders. You're getting a shortlist of lenders who will say yes - and why.

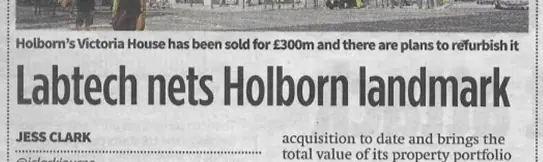

AS FEATURED IN

Our Team's Transactions

Our Team's Transactions“Labtech nets Holborn landmark”

Victoria House, £300m

Our Team in European News

Our Team in European NewsEuropean market commentary

London markets

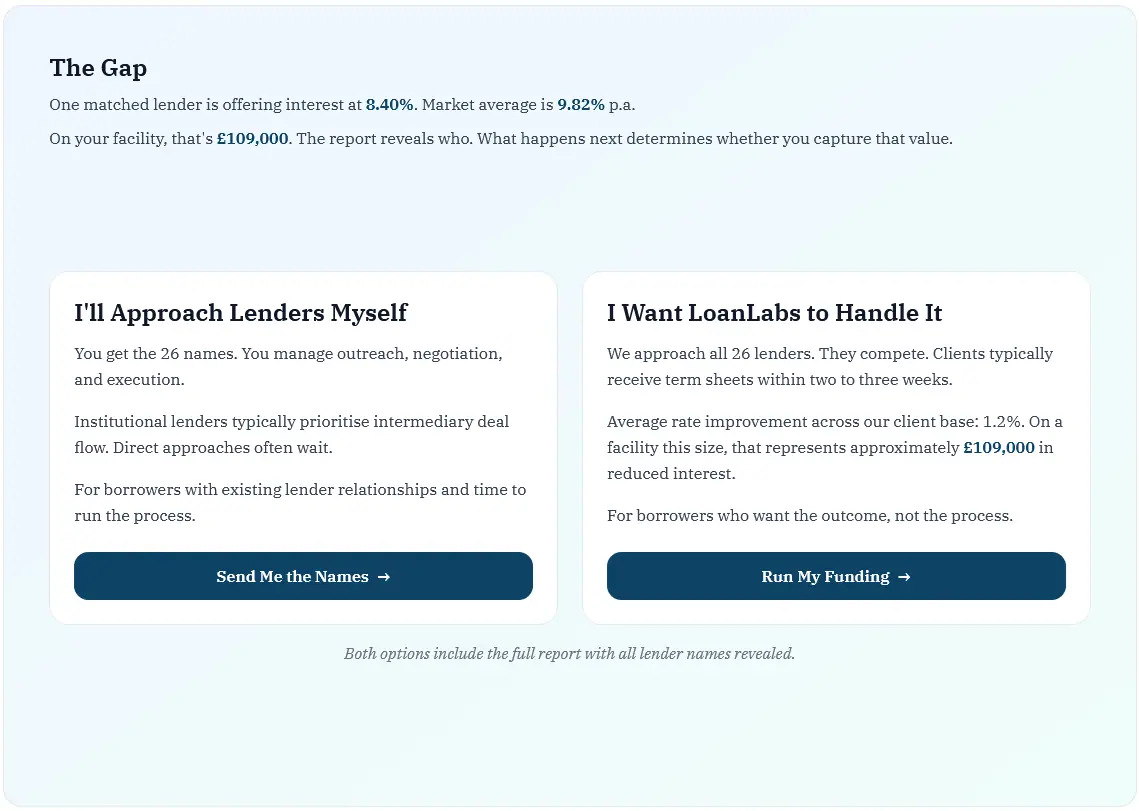

The 6 reasons lenders reject good deals

And how we fix each one. Most rejections aren't about the deal. They're about how it's presented.

“The projections aren't credible”

Lenders see inflated returns and walk away. No DCF model, no trust.

We build your DCF - the same methodology used on £1bn+ transactions.

“This doesn't meet underwriting standards”

Your spreadsheet isn't what credit committees expect. They need investment-grade models.

We produce financial models lenders actually sign off on - because we've sat on the other side.

“We don't understand what you're asking for”

Most borrowers present deals the way they see them. Lenders need it framed their way.

We translate your deal into lender language - exactly what credit committees need to see.

“We can't move on your timeline”

Sometimes traditional lenders just can't act fast enough - even when they want to.

We have our own capital. For deals that fit our criteria, we fund directly - no waiting on third parties.

“We needed this last week”

Deals go stale. Other borrowers moved faster. The market shifted.

24-hour indicative terms. Simple cases: same day. Complex cases: ~7 days. Industry average is 17 days.

“This isn't the right fit for us”

You applied to the wrong lender. They were never going to say yes.

We match you to 350+ lenders - banks, funds, family offices. Including those you can't google.

Your questions answered.

The lender who rejects youwon't tell you why.

Know what the market will actually give you - in 60 seconds.

Fundable ornot - and why

Real LTV &rate ranges

Which lenderswould say yes

Red flags -caught early

“The report showed two lenders at 75% we'd never heard of.That's £400k less equity locked up.”

- Development Director, London

No monthly fee. No lock-in. No credit card. No sales call.

_4.svg)

_10.svg)